Introduction

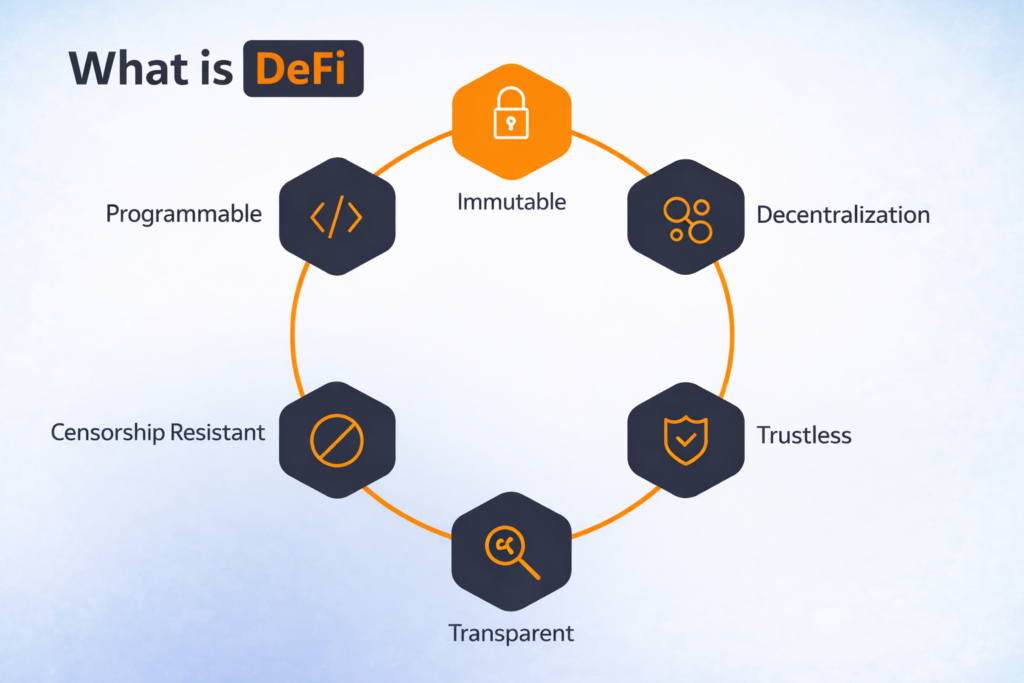

What is DeFi in simple words? DeFi stands for Decentralized Finance, a new financial system built on blockchain that allows people to borrow, lend, trade, and earn interest without using banks or traditional intermediaries.

DeFi has become one of the fastest-growing areas in cryptocurrency because it offers open access to financial services for anyone with an internet connection.

In this beginner-friendly guide, you will understand what DeFi is, how it works, its major benefits, risks, and real-world use cases.

What is DeFi?

DeFi, or Decentralized Finance, refers to financial applications that run on blockchain networks like Ethereum.

Unlike traditional finance, DeFi does not require:

- Banks

- Brokers

- Payment companies

- Central authorities

Instead, DeFi platforms use smart contracts to automate transactions.

In simple terms:

DeFi allows people to manage money directly through blockchain-based apps.

Why DeFi is Important

DeFi is important because it removes intermediaries and gives users full control over their funds.

It helps users:

- Access global financial services

- Earn rewards without banks

- Trade assets freely

- Maintain transparency

Moreover, DeFi creates a more open and inclusive financial system.

How Does DeFi Work? (Step-by-Step)

DeFi works through blockchain technology and smart contracts.

Step 1: Blockchain Provides the Foundation

First, DeFi platforms run on blockchains such as Ethereum.

Blockchain ensures transparency, security, and decentralization.

Step 2: Smart Contracts Power DeFi Apps

Next, smart contracts automate financial services.

For example:

- A lending protocol issues loans automatically

- A trading app swaps tokens without brokers

Therefore, smart contracts replace traditional middlemen.

Step 3: Users Connect Through Crypto Wallets

Instead of bank accounts, users access DeFi using wallets like:

- MetaMask

- Trust Wallet

- Coinbase Wallet

As a result, users stay in control of their assets.

Step 4: Transactions Happen Peer-to-Peer

Finally, DeFi allows users to trade or lend directly with others on the network.

This creates a decentralized ecosystem for financial services.

Popular DeFi Use Cases

DeFi offers many financial opportunities.

1. Lending and Borrowing

Users can lend crypto and earn interest.

At the same time, borrowers can access loans without credit checks.

Example platforms: Aave, Compound

2. Decentralized Exchanges (DEX)

DEXs allow crypto trading without centralized exchanges.

Example: Uniswap

Moreover, users keep control of funds during trading.

3. Yield Farming and Staking

DeFi users can earn rewards by providing liquidity or staking tokens.

However, beginners should understand risks first.

4. Stablecoins

Stablecoins like USDC and DAI help reduce volatility in DeFi.

They enable safer transactions and payments.

5. DeFi Insurance

Some DeFi platforms provide protection against smart contract risks.

This is still an emerging area in crypto finance.

Benefits of DeFi

DeFi provides many advantages:

✅ No banks or intermediaries

✅ Open access for anyone

✅ Transparent transactions

✅ Faster financial services

✅ User control over funds

In addition, DeFi supports innovation in global finance.

Risks of DeFi (Important)

Although DeFi is powerful, it also carries risks.

Smart Contract Vulnerabilities

Hackers may exploit poorly written contracts.

Scams and Fake Projects

Some projects may be unsafe or fraudulent.

Therefore, research is essential.

Market Volatility

Crypto prices fluctuate, increasing lending and liquidity risks.

Regulatory Uncertainty

DeFi regulations are still developing worldwide.

Is DeFi Safe for Beginners?

DeFi can be safe if beginners:

- Start with trusted platforms

- Avoid high-risk yield farming

- Use secure wallets

- Never share private keys

- Invest small amounts initially

Moreover, education is the best protection.

DeFi vs Traditional Finance

| Feature | Traditional Finance | DeFi |

|---|---|---|

| Control | Banks and institutions | Smart contracts and users |

| Access | Limited, requires approval | Open to anyone |

| Transparency | Low | High |

| Speed | Slower | Faster |

| Fees | Higher | Often lower |

Therefore, DeFi is changing how finance works globally.

Future of DeFi

DeFi continues to grow because of:

- Web3 adoption

- Financial innovation

- Increasing user demand

- Layer 2 scaling solutions

Although challenges exist, DeFi may reshape the future of banking and finance.

Frequently Asked Questions (FAQ)

What is DeFi used for?

DeFi is used for lending, borrowing, trading, staking, and earning rewards without banks.

Do I need a bank account for DeFi?

No. You only need a crypto wallet and internet connection.

Is DeFi risky?

Yes. DeFi involves smart contract, scam, and volatility risks, so beginners must be careful.

Conclusion

So, what is DeFi? DeFi is a decentralized financial system built on blockchain that offers open and transparent financial services without banks.

DeFi allows users to trade, borrow, lend, and earn interest directly through smart contracts.

For beginners, learning DeFi is an important step toward understanding the future of crypto finance.

Disclaimer

This article is for educational purposes only and does not provide financial or investment advice. Cryptocurrency investments carry risk.