Introduction

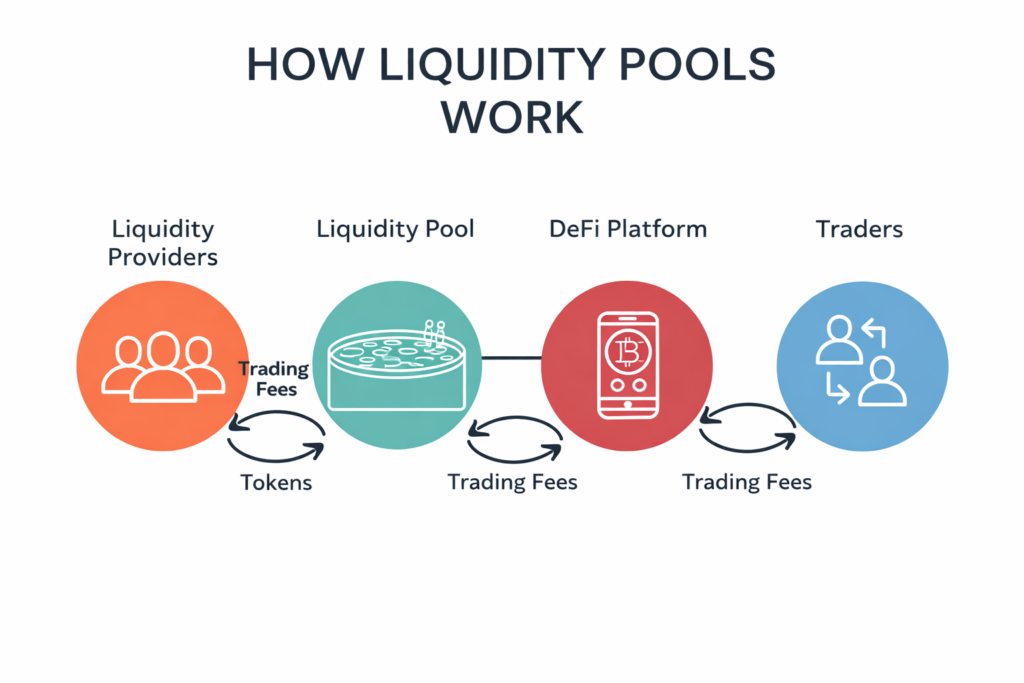

Liquidity Pools are one of the most important parts of decentralized finance (DeFi). They help decentralized exchanges operate smoothly by allowing users to swap tokens instantly without relying on traditional buyers and sellers.

If you want to understand DeFi, learning how these shared pools work is a must. In this guide, we will explain the concept step by step, including benefits, risks, and beginner-friendly tips.

What Are Liquidity Pools?

Liquidity pools are collections of crypto assets stored inside smart contracts. These pools make decentralized trading possible by providing funds that users can exchange at any time.

In simple words:

Liquidity pools allow users to trade tokens instantly by providing shared funds inside decentralized platforms.

Instead of using order books, decentralized exchanges rely on automated pools.

Why These Pools Matter in DeFi

These pools play a key role in DeFi because they:

- Enable instant token swaps

- Support decentralized exchanges (DEXs)

- Provide opportunities for earning fees

- Remove intermediaries from trading

Moreover, they create an open financial system where anyone can participate.

How Do DeFi Pools Work? (Step-by-Step)

Let’s break down the process clearly.

Step 1: Users Provide Crypto Assets

First, liquidity providers deposit two tokens into a smart contract.

For example:

- ETH + USDC

- BTC + USDT

This deposit creates liquidity for traders.

Step 2: Traders Swap Tokens Instantly

Next, traders exchange assets directly through the pool.

For example:

- Swap ETH for USDC

- Swap USDT for BTC

As a result, trading becomes fast and decentralized.

Step 3: Providers Earn Fees

In return for supplying funds, providers earn a portion of trading fees generated by swaps.

Therefore, people who support liquidity may receive rewards over time.

Step 4: Smart Contracts Manage Everything

Finally, smart contracts automatically handle pricing, swaps, and fee distribution.

This automation creates transparency and reduces the need for intermediaries.

DeFi Pools vs Traditional Order Books

Traditional exchanges work differently from decentralized platforms.

| Feature | DeFi Pools | Traditional Exchanges |

|---|---|---|

| Trading Method | Automated swaps | Buyer-seller order matching |

| Custody | Users control funds | Exchange holds funds |

| Transparency | High | Limited |

| Accessibility | Open to anyone | Requires approval/KYC |

So, decentralized pools offer a new way of trading without central control.

Benefits of Liquidity Pools

Liquidity pools offer several advantages:

✅ 1. Decentralized Trading

Users can trade without relying on centralized exchanges.

✅ 2. Passive Reward Opportunities

Liquidity providers may earn fees and incentives.

✅ 3. Supports DeFi Innovation

Pools power DeFi services like:

- Yield farming

- Lending

- Stablecoin trading

✅ 4. Open Access

Anyone with a crypto wallet can participate.

Risks of Liquidity Pools (Important)

Liquidity pools also involve risks.

Impermanent Loss

If token prices change sharply, providers may lose value compared to holding tokens.

Smart Contract Vulnerabilities

Poorly coded contracts may lead to hacks.

Scams and Rug Pulls

Some projects create fake pools and steal funds.

Therefore, beginners should use trusted platforms.

Popular Liquidity Pool Platforms

Some well-known DeFi platforms include:

- Uniswap (Ethereum)

- Curve Finance (Stablecoin pools)

- PancakeSwap (BNB Chain)

- SushiSwap

Always research carefully before using any pool.

Beginner Tips for Liquidity Pools

Here are safe beginner strategies:

✅ Start with stablecoin pools for lower volatility

✅ Avoid unknown projects promising huge returns

✅ Invest small amounts initially

✅ Learn about impermanent loss

✅ Use secure wallets and 2FA

Moreover, education is the best protection in DeFi.

Frequently Asked Questions (FAQ)

What are liquidity pools used for?

Liquidity pools enable decentralized trading, token swaps, yield farming, and DeFi rewards.

Can beginners use liquidity pools safely?

Yes, but beginners should start small and use trusted platforms.

What is impermanent loss?

Impermanent loss occurs when token prices change, reducing the value of pooled assets.

Conclusion

Liquidity pools are a core part of DeFi that make decentralized trading possible. They allow instant swaps, reward liquidity providers, and support platforms like Uniswap.

However, they also carry risks such as impermanent loss and smart contract vulnerabilities. Therefore, beginners should start carefully, research platforms, and focus on security.

Understanding liquidity pools is an important step toward exploring DeFi responsibly.

Disclaimer

This article is for educational purposes only and does not constitute financial or investment advice. DeFi investments carry risk.